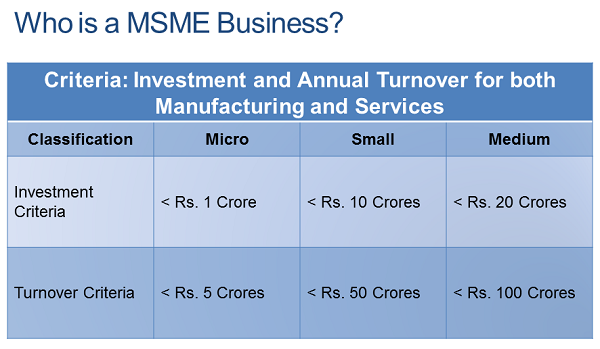

On 13th May 2020, Smt. Nirmala Sitharaman, The Minister of Finance, Government of India issued a new Definition of Micro, Small and Medium Enterprises (MSME) in line with the international Standards. Earlier the criteria to define an MSME was only interms of Investments which was modified to include Turnover of the company too as part of MSME. Further on the criteria were different for Manufacturing and Services businesses which was merged into one Homogeneous solution. Hence now the MSMEs are defined as follows

However to be notified as MSME, the Ministry of MSME has launched a Registration process by name Udyam Registration which is in effect from 1st July 2020 and is a unique identification number built on the lines of UIDAI’s Aadhar Number that identifies the MSME business.

What is Udyam Registration?

Udyam Registration or Udyam Registration Memorandum Number or URM Number is a Unique Identification Number provided by the Ministry of MSME, Government of India for small and medium enterprises in India. It can be considered as the Aadhaar Number for Busineses

By having URMnumber businesses can claim various benefits that includes Financial Benefits, Marketing Benefits, Operational / Organizational benefits and also Claim many Schemes and Subsidies from the government.

Who can apply for Udyam Registration?

Any one can Register to Udyam Registration irrespective of the type of business. It could be a Manufacturer, a Trader or even a Services businesses. The business could be either a proprietary ship company or a Private limited or any type. The business can be of any industry both Organized and Un-organized sector only guideline is as per the above diagram.

So You can own a Udyam Registration and register with MSME. By default most businesses are Micro businesses

Benefits of Udyam Registration

There are various benefits by having the MSME certificate and registering with the MSME. You are not only invited to their programmes, but you are also helped to ensure your business sails smoothly and you offer the best solutions

Financial Benefits

- Protection against delay in payment.

- Collateral Free loans from bank

- Waiver of Stamp duty and Registration fees

- Several Exemption under Direct Tax Laws

- Counter Guarantee from GoI through CGSTI

- Reduced rate of interest from banks

- Concession in Electricity Bills

- Reimbursement of payment made for obtaining ISO certification

- 1% exemption in interest on OD

- Increasing eligible loan limit for optimal reasons, from the amount of Rs. 25 lakh to Rs. 50 lakh

Marketing Benefits

- Exclusive consideration for participating in international trade fair

- Exclusive consideration for participating in Local trade fairs

- Exemptions while applying for Government tenders

- Reservation of products for exclusive manufacturing by MSME/SSI

- 25% Reservations for MSMEs in Public Procurement Policy of PSUs, Central Governments and Ministries

- Access to Various Vendor Development Programmes

- Women and SC/ST Entrepreneurs get Special considerations in marketing their products & services

Organizational / Operational Benefits

- Fast resolution of disputes

- Octroi benefits

- Raising the extent of guarantee cover from 75 % to 80 %

- Easier registration and approvals to obtain Licenses

- Preference in allocation of Government tenders

- Zero Defect Zero Effect (ZED) Management and Certification

- Acquire raw materials, labour, permissions, etc.

- Access to Clusters for grouped usage of resources, services and machinery of specific industry

- Testing Centers for MSMEs

- Entrepreneurial and Managerial Development Trainings

- Entrepreneurship Skill Development Trainings

Government Subsidies and Schemes

- Barcode registration subsidy

- Subsidy on NSIC Performance and Credit ratings

- 15% subsidy under CLCSS scheme for technology upgradation

- Eligible for IPS subsidy

- Excise Exemption Scheme

- 50% subsidy for patent and trademark registrations

- Credit Guarantee Scheme for Micro and SmalI Enterprise (CGTMSE)

- Prime Minister Employment Generation Programm

- Fund for Regeneration of Traditional Industries

and many more…

All the benefits of previously held Udyog Aadhar Memorandum has been ported to Udyam Registration.

How to Apply for Udyam Registration?

Udyam Registration can be applied by filling the application form at http://www.udyamregistration.gov.in. You need to fill around 25 questions which are categorised into 10 segments. Ensure you have your PAN CARD, AADHAR CARD, UDYOG AADHAR NUMBER (if any), GST NUMBER

If you need any FREE assistance for filing Udyam Registration

Disclaimer: We donot claim that the images used as part of the news published are always owned by us. From time to time, we use images sourced as part of news or any related images or representations. Kindly take a look at our image usage policy on how we select the image that are used as part of the news.