On the 13th of May 2020, Finance Minister Nirmala Sitharaman declared a new classification for MSMEs to merge Manufacturing and Services Segmentation and also to Include Turnover along with Investment to classify MSMEs as Micro, Small and Medium in accordance with the World standards. This new classification was approved by the Union cabinet on 1st June 2020 and the result of which UDYAM Registration process came into effect from 1st July 2020.

Udyam Registration supersedes all other registrations i.e. EMII or Udyog Aadhar Registrations. Currently Udyog Aadhar is on status quo and no new registrations or modifications are allowed. Udyam Registration has been is structured such a way that It links to various Government databases such as Organizations’ PAN, IT and GST and automatically pull out the Turnover and Investment information. This is required for Udyam Registration to upgrade or downgrade any organization within the MSME classification.

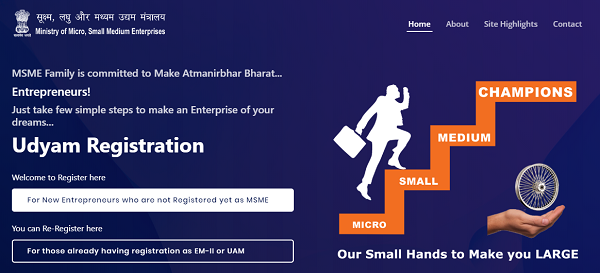

The procedure for Udyam registration is based on your current registration. If the organization is already registered under Udyog Aadhar, then they have to follow a simple procedure set forth in “Upgrading Udyog Aadhar to Udyam Registration; things you need to know” document. However if the organization does not have a Udyog Aadhar Registration or is a New organization, then the below comprehensive step by step procedure should be followed to Register for New Udyam Registration

- Go to Udyam Registration Website (www.udyamregistration.gov.in)

- Select the “For New Entrepreneurs who are not Registered yet as MSME”

- You should see a form to start the process. The process has 25 fields or sub-sections segmented into 8 sections.

Pre-requisite

Government Documents that you need to have with you before applying for the New Registration

- You will need to have the AADHAR CARD & PAN CARD ready with you

- The cards should be that of the Proprietor (Proprietorship Firm), Managing Partner (Partnership firm) or Karta (Hindu Undivided Family business)

- In case of Company, Private Limited, Limited Liability Partnership, Co-operative society, or a Trust, then the Aadhar Number of the Authorised Signatory should be submitted and the PAN number attached to the Organization should be submitted

- GST Number is required for Udyam Registration. However for now this is not requested as GST number is internally linked to PAN Number and hence it will be acquired from your PAN

- Income Tax (ITR) details are required for Udyam Registration. But since they are interlinked to PAN number, the PAN information is sufficient

Section 1: Aadhar Verification with OTP (Fields 1 & 2)

The first step is to validate the Aadhar Number and the Name as in Aadhar card of the applicant. The applicant should be the primary and authorised signatory of the organization.

Once Details are submitted and VALIDATE & GENERATE OTP button is clicked, An OTP will be sent to the mobile number registered with Aadhar Card which has to be submitted and validated

Section 2: PAN VERIFICATION (Fields 2, 3 & 4)

Once you have submitted the Aadhar Number, the next step is to validate your PAN CARD. After validating the PAN card, provide details if you have filed the last years ITR and if you have GSTIN registered for your organization

Section 3: Applicant Details (Fields 5 – 10)

The Basic Details of the applicant is collected in this section. The details are about the organization, applicant details and contact details

Section 4: Organization Location (Fields 11,12 & 13)

The place and address of execution of business of the Organization and its Execution centers.

Section 5: Other Organization Details (Fields 14-19)

This section collects all other details about the organization commencements, previous registration details, Status, Number of employees, Business Type and NIC Codes of all Products and services

Section 6: Investment Criteria of the Organization

This section defines the Investments made towards Capital Assets of the organization. This information is collected from the ITR 3, 5, 6 if the PAN is linked and else has to be self-declared

Section 7: Other Details (Fields 22, 23 & 24)

These are other details to help connect with public/government bodies.Most of them are Yes/No type questions and based on the interest of the owner, it is recorded.

Section 8: Acceptance and Generation of E-Certificate

The Final acceptance of the documentation provided and submitting to get the final OTP to generate the E-Certificate.

NEED SUPPORT?

If you want support towards Udyam Registration. You can Download our SupportMitra App at http://www.supportmitra.com/app.html with Referral code as I10KSME and raise a request and we shall support you on the same AT NO COST. We will send you a COMPREHENSIVE step-by-step procedure with images and explaining each field and what to fill there.

Disclaimer: We donot claim that the images used as part of the news published are always owned by us. From time to time, we use images sourced as part of news or any related images or representations. Kindly take a look at our image usage policy on how we select the image that are used as part of the news.