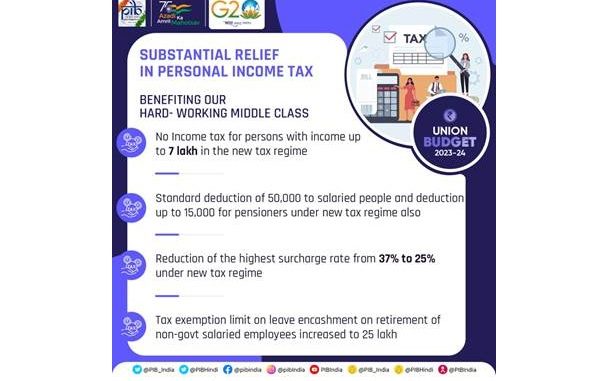

Feb 01: With the objective of benefitting the hard-working middle class of the country, Union Minister for Finance and Corporate Affairs, Smt. Nirmala Sitaraman made five major announcements with respect to personal income tax while presenting the Union Budget 2023-24 in Parliament today. These announcements pertaining to rebates, a change in tax structure, an extension of the benefit of the standard deduction to the new tax regime, a reduction of the highest surcharge rate and an extension of a limit of tax exemption on leave encashment on the retirement of non-government salaried employees will provide substantial benefits to the working middle class.

In her first announcement regarding rebate, she proposed to increase the rebate limit to Rs.7 lakh in the new tax regime, which would mean that the persons in the new tax regime, with income up to Rs. 7 lakhs will not have to pay any tax. Currently, those with income up to Rs. 5 lakhs do not pay any income tax in both old and new tax regimes.

Providing relief to middle-class individuals, she proposed a change in the tax structure in the new personal income tax regime by reducing the number of slabs to five and increasing the tax exemption limit to Rs. 3 lakhs. The new tax rates are:

| Total income (Rs.) | Rate (per cent) |

| Upto 0-3 lakh | Nil |

| From 3-6 lakh | 5 |

| From 6-9 lakh | 10 |

| From 9-12 lakh | 15 |

| From 12-15 lakh | 20 |

| Above 15 lakh | 30 |

This will provide major relief to all taxpayers in the new regime. An individual with an annual income of Rs. 9 lakhs will be required to pay only Rs. 45,000/-. This is only 5 per cent of his or her income. It is a reduction of 25 per cent on what he or she is required to pay now, i.e. Rs. 60,000/-. Similarly, an individual with an income of Rs. 15 lakhs would be required to pay only Rs. 1.5 lakh or 10 per cent of his or her income, a reduction of 20 per cent from the existing liability of Rs. 1,87,500/.

The third proposal of the budget provides major relief to the salaried class and the pensioners including family pensioners as the Finance Minister proposed to extend the benefit of the standard deduction to the new tax regime. Each salaried person with an income of Rs. 15.5 lakhs or more will thus stand to benefit by Rs. 52,500/-. At present, a standard deduction of Rs. 50,000/- to salaried individuals and a deduction from family pensions up to Rs. 15,000/- is currently allowed only under the old regime.

As part of her fourth announcement with respect to personal income tax, Smt. Nirmala Sitaraman proposed to reduce the highest surcharge rate from 37 per cent to 25 per cent in the new tax regime for income above Rs. 2 crores. This would result in a reduction of the maximum tax rate to 39 per cent from the present 42.74 per cent, which is among the highest in the world. However, no change in surcharge is proposed for those who opt to be under the old regime in this income group.

As part of the fifth announcement, the budget proposed an extension of a limit of tax exemption on leave encashment to Rs. 25 lakhs on the retirement of non-government salaried employees in line with the government salaried class. At present, the maximum amount which can be exempted is Rs. 3 lakhs.

The budget proposed to make the new income tax regime the default tax regime. However, citizens will continue to have the option to avail the benefit of the old tax regime.

Disclaimer: We donot claim that the images used as part of the news published are always owned by us. From time to time, we use images sourced as part of news or any related images or representations. Kindly take a look at our image usage policy on how we select the image that are used as part of the news.