May 26: India has become one of the largest consumers of vegetable oils. Changing Food habits, increasing spending capacity, and instant food requirements are becoming one of the key reasons for the increase in edible oils which forms the primary needs of changing food habits. Though the current demand is around 75M tonnes, it could easily increase to 100M tonnes in the near future. However, our current production is less than 30M tonnes. This poses a huge opportunity to Agriculturists and Industrialists to explore more opportunities in the Indian Edible Oils Industry.

In India, the demand for Edible oil is so high that local productions are inadequate. Hence India imports huge quantities of edible & vegetable oils from countries like Malaysia and Indonesia. However, this could change if the production is increased and new opportunities are identified within the country.

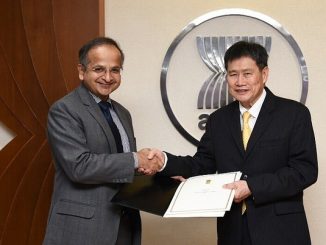

In a recent Interview by Teflas with Dr B V Mehta, he identified various opportunities that could increase the production of Edible Oil in India and be self-reliance.

Dr. B V Mehta is a name synonymous with the edible oil industry in India, a treasure trove of knowledge and the dynamic link between the industry and the government. He is also the Executive Director of SEA of India.

Transcript of the Interview

What are the Major Oilseeds that can be substituted to the current imports of edible/vegetable oils?

The demand for edible oil in India is growing due to population growth. The area under oilseed production can be enhanced keeping in mind the requirement of our country. For example, with our storage system for wheat /Rice getting seriously choked. It is high time, we broke this Wheat /Rice cycle and replaced it with Soya/ Mustard cycle partially in the Northern States of Punjab/Haryana.

Agriculture is a climatic specific activity, therefore it should be a location-specific strategy. This strategy should have two parts: technology and trade policy. Unless there is enough cushion from the threat of cheaper import, will not attract the investment in production technology.

There are three crops where major technology interventions are required:

1. Soybean

2. Mustard/Rapeseed/Canola seed oil

3. Groundnut

Palm can be explored in South India and North East where climatic conditions are favourable.

Important:

What should be the share between oils: It does not matter because oil is cooking medium. Whichever is cheap, institutions will consume the same. All Oils have some good quality and it is futile to promote one oil over the other. India is a price-sensitive market and whichever oil is competitively priced will have an edge with Consumers and Institutions.

Demand: We should plan an average of 17 kg per year per person. This will increase with the rise in per capita income. With a population of 1.35 Billion, current demand is about 23.0 million tonnes. We are expecting some demand destruction due to COVID during the current year. Once the situation normalizes, we can expect a normal growth of around 1.5 to 2% per annum.

How does oil palm compare with other Oilseeds in terms of opportunity and economics of production in India?

Palm is one of the most efficient oils in the world. On an average per hectare yield in case of Palm oil is the highest among all oilseeds in the world. One Hectare gives a yield of 5 tons of palm oil whereas soya gives only around 400 kgs worldwide. In the Indian context with low yields of Soya at 1000kg/Ha, the output is only less than 200 kgs/hectare. There is absolutely no comparison whatsoever between Palm and Other oilseeds in terms of efficiency. Palm oil is the largest edible oil products in the world in terms of Volume and almost 40% of World consumption. Most of the Food products worldwide use Palm as it is cost-competitive. Palm oil due to competition from other oils has been the target of NGOs. However, in spite of motivated criticisms, its consumption keeps growing worldwide. Hence, we should take the criticism with a pinch of salt.

Can India be self-sufficient in Edible Oils production? What are the ways to reduce imports?

Based on the demand and area under oilseeds cultivation coupled with low productivity, India will find it very tough to attain self-sufficiency. Current consumption of edible oil equivalent to oilseed demand is 75 Million tonnes against which our country is producing just around 30.0 million tonnes. The gap is huge. However to reduce dependence.

- Policy support to encourage palm cultivation by bringing additional

- Lakh. Hectare in palm cultivation in the next 5 years.

- Wheat can be shifted to Mustard/rapeseed and Canola in North India.

- Kharif Paddy can be shifted to the soybean area.

What are the major levers that would help India on the right path towards self-sufficiency in Vegetable oils?

The government must ensure that at all times, imported oil must not be cheaper than domestically produced edible oil. When MSP is revised, customs duty should be revised proportionately. R&D centres should focus on high yielding variety and extension services.

SEA is willing to join hands with GoI in Mustard Mission as we feel Mustard has a great future in India.

What interventions, if any, can be made to influence consumption patterns for minimizing imports of vegetable oils?

Indian consumption is not high in comparison to the world average. Indian consumption of oils is not uniformly distributed across the country. Some pockets consume very high and some very low depending on affluence level. In India what needs to be done is as below.

- Western India which is relatively more prosperous and the consumption is in excess of 25 kgs should be targeted for lowering consumption.

- UP/ Bihar /Orissa consumption is low and need not be targeted in advertisements.

What interventions, if any, can be made to influence consumption patterns for minimizing imports of vegetable oils?

Short Term Agenda should be:

Low Import duties on edible oils over the years has practically made our farmer’s loose interest in Oilseed cultivation. No wonder our Oilseed production has remained stagnant but consumption of edible oils driven by improved affluence has skyrocketed and has been growing at the rate of 3 to 4% per annum. In the last few years attempt has been made to correct this anomaly. However, the Agreements which India had signed with Indonesia and Malaysia way back in 2010 is not allowing India to raise duties. Good news is that the period of the Agreements have now come to an end and India is free to raise duties. We would suggest the following

- Soya and Sunflower Oil duties should be raised to 45% from the current 35%

- Crude Palm Oil duties should be raised to 50%.

- Import Of Refined Palm Oil or Palmolein should be totally banned as it is against our Prime Ministers call of Make in India.

- We feel the above measures would help raise local Oilseed prices which in turn would enthuse our Oilseed farmers besides increasing revenue for the Government. Banning of Refined Palm Oil and Refined Palmolein would help Indian Refining Industry in saving jobs in these difficult times. Needless to say, the capacity utilisation of our Palm Refining Industry is currently around 30% and fear of runaway inflation is totally unfounded.

- High Oil Import duties would also help in better exploitation of Non-Traditional sources like Rice Bran Oil, Cottonseed Oil and Tree bore Oilseeds. Needless to say, huge potential exists and can add at-least One million tonnes in Edible oil pool.

National Mission on Edible Oils

- It is imperative that the National Mission on Edible Oils is launched without further delay and the Private Sector should also be involved. This should go a long way in moving towards Self Reliance in Edible Oil.

- Oilseed Mission should be adequately funded for achieving meaningful results. Oilseed Development Cess of Rs.2000 per MT should be levied on imports of Edible oils. This Levy will generate approximately Rs 3000 Crore annually which should additionally be diverted to Oilseed Development. In nutshell Oilseed Development in the country can be funded through a Cess with no additional burden on the exchequer.

LONG TERM MEASURES:

Shifting of Crops

Encourage Farmers from Punjab & Haryana to divert land to Corn or Sunflower In Kharif and Mustard In Rabi. We should target 25% of land diversion as it would go a long way in breaking the Wheat / Rice cycle in these states. Needless to say, we keep producing wheat and rice much in excess of our requirement and importing Edible oils. This diversion would also help in reducing the destruction of the water table in these states which is the need of the hour.

Adequate arrangements will have to be made for incentivising the farmers and procuring their produce in initial years to give price protection. Private Sector Support can be galvanised for this initiative.

Palm Plantation:

It is rather unfortunate and beyond comprehension that Palm is not treated as Plantation Crop even though the world over it is Plantation Crop. It is high time we declare Oil Palm as Plantation Crop. Due to this anomalous situation of not treating Oil Palm as Plantation Crop, Private Sector cannot invest in Palm Plantation even though huge opportunity exists in India. As per the study conducted by Government India, the potential of 2.0 Million hectares for Oil Palm cultivation exists against this the current area under Oil Palm is only 0.3 million Hectares. A huge opportunity exists.

Needless to say, Palm Oil yields is at around 4 tons per hectare is the highest among all Oilseeds and would go a long way in reducing our import dependence. The potential of Palm Oil Production in India is almost 8.0 million tons against current production of about 0.27 million ton only. We would suggest fixing a target of bringing a minimum of 1.0 million hectare area under Oil Palm in the next 4 years.

Dr. B V Mehta will also be a speaker in the upcoming 24th Anniversary event of GLOBOIL.

Report filed by Jairaj Srinivas, Teflas

Come and Participate in the upcoming 24th Anniversary event of GLOBOIL, a much-awaited event in the Edible Oil and Agri Trade Industry which is being held on 30th October 2020 to 1st November 2020 at Taj, Goa. The hybrid event will have both Physical and Virtual Presence. For Event Participation, Tickets and other details